In the ever-evolving landscape of financial technology, one company is making significant strides in redefining how businesses and consumers interact with financial services. Teya, a pioneering fintech company, is at the forefront of this transformation, offering innovative solutions that cater to the diverse needs of its clients. This blog explores what makes Teya stand out in the crowded fintech space and how it is driving the future of finance.

A Vision for the Future

Mission and Values

Teya was founded with a clear mission: to democratize access to financial services and empower businesses and individuals to achieve their financial goals. At its core, Teya is driven by values such as innovation, inclusivity, and customer-centricity. The company believes in creating financial solutions that are not only cutting-edge but also accessible and beneficial to all.

Commitment to Innovation

Innovation is at the heart of Teya’s operations. The company invests heavily in research and development to stay ahead of industry trends and continuously improve its offerings. By leveraging the latest technologies, including artificial intelligence, blockchain, and data analytics, Teya develops products that address real-world challenges and enhance the financial ecosystem.

Comprehensive Product Suite

Digital Banking Solutions

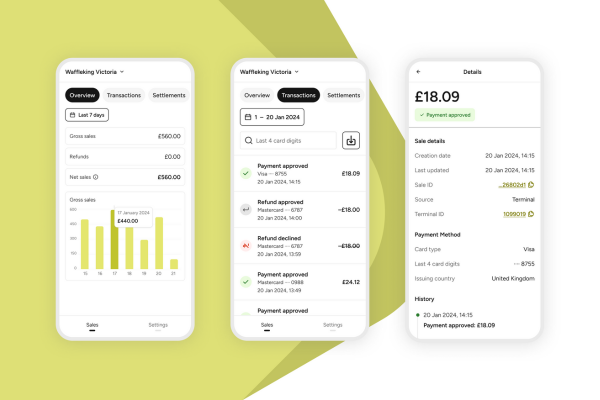

Teya offers a range of digital banking services designed to meet the needs of modern consumers and businesses. From digital wallets and payment gateways to online banking platforms, Teya’s solutions provide seamless and secure financial management. These services are tailored to offer convenience, speed, and security, ensuring that users have complete control over their finances.

Merchant Services

For businesses, Teya provides an array of merchant services that simplify payment processing and enhance customer experience. These services include point-of-sale (POS) systems, e-commerce payment solutions, and mobile payment options. Teya’s merchant services are designed to integrate effortlessly with existing business operations, helping merchants accept payments in various forms and streamline their financial processes.

Lending and Credit

Recognizing the critical role of credit in economic growth, Teya offers innovative lending solutions that cater to both personal and business needs. The company utilizes advanced algorithms and data analytics to assess creditworthiness and offer competitive loan products. This approach not only accelerates the lending process but also ensures fair and transparent access to credit.

Investment and Wealth Management

Teya’s fintech solutions extend to investment and wealth management, providing users with tools to grow and manage their wealth. Through intuitive platforms, users can access a range of investment options, from stocks and bonds to cryptocurrencies and mutual funds. Teya’s wealth management services are designed to provide personalized recommendations and insights, helping users make informed investment decisions.

Commitment to Security and Compliance

Robust Security Measures

In the digital age, security is paramount. Teya prioritizes the protection of its users’ data and financial assets through state-of-the-art security measures. The company employs encryption, multi-factor authentication, and continuous monitoring to safeguard against cyber threats. By ensuring the highest standards of security, Teya builds trust and confidence among its users.

Regulatory Compliance

Teya operates in a highly regulated industry and places significant emphasis on compliance. The company adheres to all relevant financial regulations and works closely with regulatory bodies to ensure that its operations are transparent and lawful. This commitment to compliance not only protects Teya’s reputation but also ensures that its users can trust the integrity of its services.

Customer-Centric Approach

Personalized Customer Service

Teya understands that exceptional customer service is key to building long-term relationships. The company offers personalized support through multiple channels, including phone, email, and live chat. Teya’s customer service team is trained to provide prompt and effective solutions, ensuring that users have a positive experience at every touchpoint.

User-Friendly Interfaces

One of Teya’s strengths is its focus on creating user-friendly interfaces. Whether it’s a mobile app or a web platform, Teya’s products are designed with the user in mind. The intuitive design, easy navigation, and clear instructions make it simple for users to manage their finances, regardless of their level of tech-savviness.

Impact and Future Prospects

Driving Financial Inclusion

Teya is committed to driving financial inclusion by providing access to financial services for underserved populations. Through its innovative products and outreach initiatives, Teya aims to bridge the gap between the unbanked and the formal financial system, fostering economic growth and stability.

Future Innovations

Looking ahead, Teya is poised to continue its trajectory of growth and innovation. The company plans to expand its product offerings, explore new markets, and leverage emerging technologies to further enhance its services. With a strong foundation and a clear vision, Teya is set to remain a leader in the fintech industry.

Teya’s journey in the fintech space is marked by a relentless pursuit of innovation, a deep commitment to customer satisfaction, and a vision to transform financial services. By offering comprehensive and secure financial solutions, Teya is empowering businesses and individuals to navigate the complexities of the financial world with confidence. As the fintech landscape continues to evolve, Teya’s dedication to excellence and inclusivity ensures that it will remain a significant player in shaping the future of finance.